By Joel Dresang

My eyes lingered on the towel hanging in our bathroom. It’s thin and long with vertical teal-and-white stripes. A gift from a friend. For our wedding. Thirty-four years ago.

It’s evidence that Americans shouldn’t rely on me to save the economy.

An article in The Wall Street Journal suggested as much, without singling me out by name. It said “seniors” have the wherewithal and willingness to keep spending money and could be the USA’s ace in the hole should the economy sink too far south amid rising interest rates and global uncertainty.

The article pointed out that those of us 65 and older are well-heeled as a group and less likely to be subject to the budgetary plagues of younger consumers – rising costs for childcare and rents; higher interest on mortgages, credit card debt and car loans; resumption of student loan payments.

Consumer spending fuels the U.S. economy, accounting for more than two-thirds of gross domestic product. Spending has slowed amid the Fed’s attempts to calm inflation through higher interest rates. Still, consumer resilience has confounded many economists. “Consumer strength has been one of the great surprises of 2023,” J.P.Morgan said in a recent report.

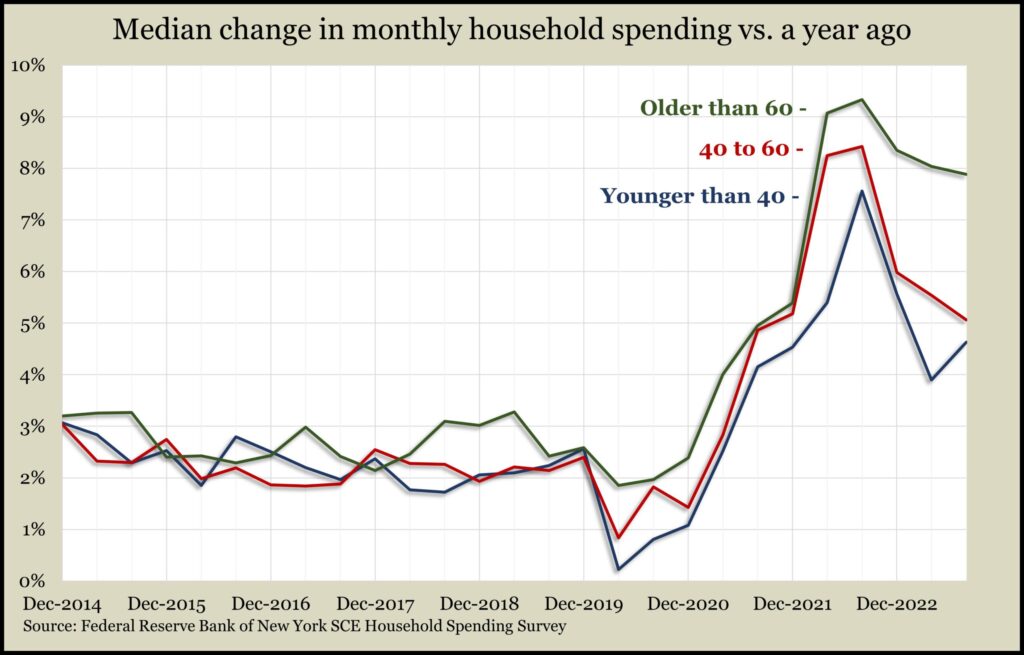

The Federal Reserve Bank of New York’s latest research on household spending shows those older than 60 have been spending around 8% more than they did a year ago. That compared to around 5% for consumers between the ages of 40 and 60 and around 4.5% for those younger than 40.

Fed data shows the olders consistently outpacing the youngers. And although the pace has slowed since the Fed started raising interest rates in 2022, the gap has widened recently.

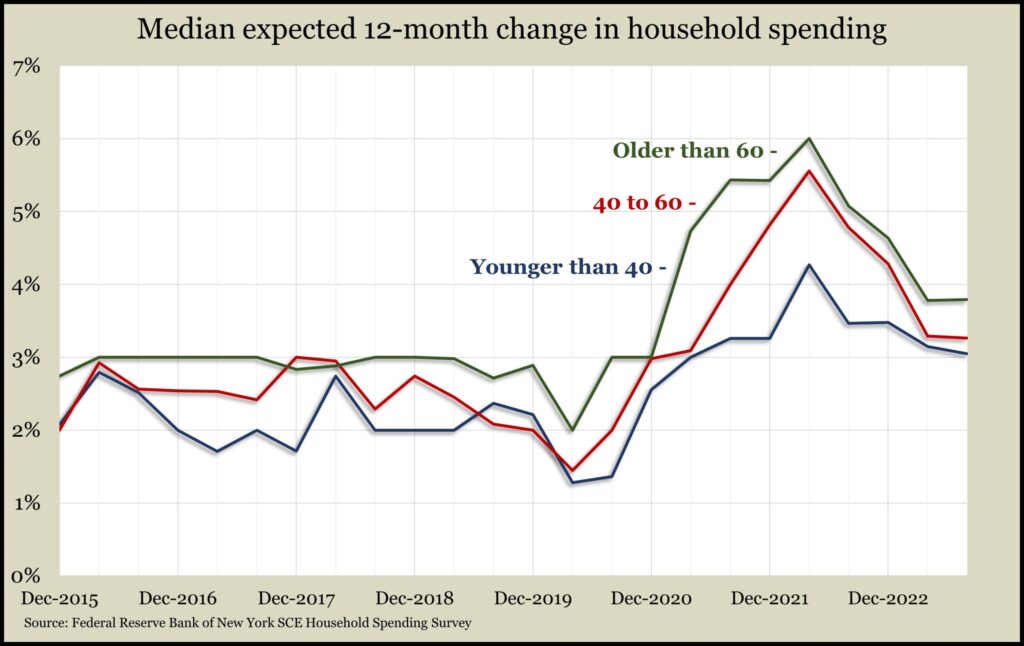

Plus, those older than 60 have higher expectations for spending in the coming year, the Fed reported. Based on two sets of surveys, households almost always spend more than they expect, but the elders clearly command the lead. Generally, they can afford to.

Of course, retirees don’t have the security of the steady incomes they earned when they were working, but they’re more likely to have accumulated investments and home equity that have been boosting their wealth.

A separate Fed report on changes in family finances shows that those families headed by someone 65 to 74 had the highest median net worth ($409,900) of any age group in 2022. That wealth grew by 33% from 2019, second only to families headed by 55- to 64-year-olds, who benefited more from having employment income.

So, besides showing the strongest inclination among age groups to increase spending, seniors also tend to be wealthier. And on top of gains in investments and home values, retirees got an 8.7% raise in Social Security benefits this year, the most in four decades.

“All three of those things (investments, home values and the cost-of-living adjustment) support more confidence in spending,” Kyle Tetting explained during a recent Money Talk Podcast.

Kendall Bauer noted in the same podcast that although many people complain about rising costs, they also continue to spend, especially retirees, especially post-pandemic.

“I think that generation – the baby boomers – were in a position to kind of weather the storm,” Kendall said, “and I think that has helped lift the economy or at least carry us through a substantial rate hike campaign by the Fed.”

At the same time, though, the very trait that has led many investors to a comfortable retirement is financial discipline. Which makes me wonder how much of their saving mentality they’ll squander in the months ahead.

“I tell customers they’re not going to run out of money because they’ve built good habits,” Kyle said, “except for the ones who haven’t.”

Before the pandemic, Steve Giles said, many retirees needed a nudge from their advisors to spend what they could afford.

“It was part of our responsibility to give clients the courage and the confidence to take money out of their retirement portfolios,” Steve said on the podcast. “It’s so hard, as an individual, as a saver, to go your entire life saving, saving, saving, growing, growing, growing. Do I have enough? Do I have enough? And when you finally pull the trigger and realize that you’re retired, that you don’t have a paycheck coming in, and you still have to spend money, that’s a hard transition to make.”

Other Money Talk articles from Joel Dresang

For the two Christmases leading up to the pandemic, I had given my wife a couple of travel guidebooks – one to Austria, one to Paraguay – as suggestions for trips we could take. When the lockdown came, we journeyed as far as a couple of car trips to visit our daughter in Pennsylvania.

Just before the pandemic, in 2019, we flew to the Grand Canyon for a family vacation. We had a trip apiece to Colorado to visit our daughter there. We also had a long weekend in New Orleans to celebrate our wedding anniversary.

But our parents grew up in the Depression. We still have that old bath towel. At the onset of COVID, while many consumers were refurbishing their rec rooms and amping up their entertainment equipment, we ordered a replacement vacuum cleaner from Target.

We did get to Paraguay this year. We also took a few days for sightseeing and a couple of Broadway shows in New York.

Steve said he’s seen some retirees splurge since COVID let up. For anyone who verged on going overboard, he offered the same advice he gave before the pandemic: Feel secure to spend what you can afford.

“Part of how I help clients gain the confidence to spend that money in retirement is to just do the math,” Steve said. Historically, withdrawing about 4% from a balanced investment portfolio (about 60% stocks, 40% bonds) has provided a yearly disbursement while still preserving the principal. The formula can vary by individual.

“Don’t take more than 4-5% out and do all the trips you want. I don’t care how you spend it,” Steve said. “But if you’re worrying about how much you’re going to spend on your trip, I think that’s the wrong question. It’s how much of my portfolio do I need to take out to afford these things that I want to buy?”

I remain skeptical of how much retiree spending can cushion an economic downturn – if indeed one is looming.

Figures from the Bureau of Labor Statistics show those 65 and older are punching under their weight, accounting for 22% of spending while representing nearly 28% of all consumers. Their average annual expenditures ($57,818) are the lowest of any age group older than 25.

Sure, the oldest spend the most on health care and reading material. But on average, they spend less than other age groups over 25 on transportation, entertainment, apparel and housing – because 51% of them own homes free of mortgages.

The numbers suggest that compared to other age groups, those of us 65 and older can afford to spend more. As for me, I know of no plans to replace that old bath towel. On the other hand, the guide to Austria is still on the kitchen counter.

Joel Dresang is vice president-communications at Landaas & Company.

Learn more

Spend to save the economy, by Joel Dresang

Safe investment withdrawals for retirees, a Money Talk Video with Art Rothschild

Retirement: Thinking about spending, by Joel Dresang

How much to spend in retirement, by Art Rothschild

You need a budget, by Tom Pappenfus (including budgeting tools)

Retirement 101: Having a plan, a Money Talk Video with Tom Pappenfus

(initially posted Nov. 6, 2023)

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.